Veteran Services

VA loans provide eligible Veterans and military spouses with exclusive advantages to assist them in realizing their dream of homeownership. These benefits include zero down payment requirements, no private mortgage insurance, and typically lower interest rates than the market average, making VA loans one of the most desirable options available. To ensure that this program is available to future generations of Veteran homebuyers, the Department of Veterans Affairs mandates that most borrowers pay the VA funding fee.

VA loans offer distinctive benefits to qualifying Veterans and military spouses, which include zero down payment requirements, no private mortgage insurance, and generally lower interest rates compared to the market average. As a result, VA loans are a highly sought-after option for those seeking homeownership. To ensure the longevity of this program and continue providing support to future generations of Veteran homebuyers, the Department of Veterans Affairs mandates that most borrowers pay the VA funding fee.

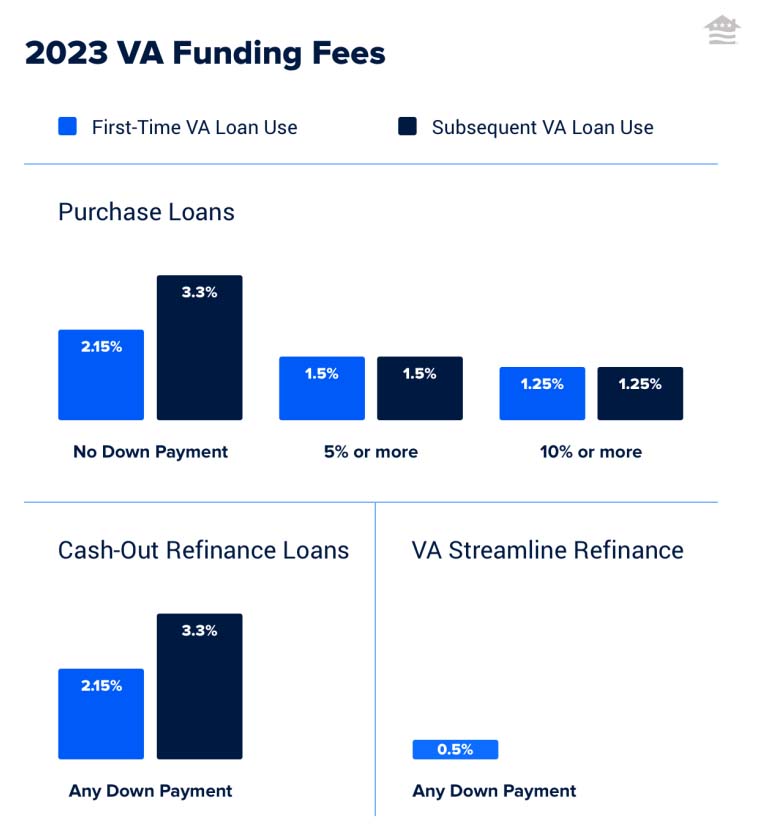

The VA funding fee is a one-time fee paid to the Department of Veterans Affairs, typically at closing. While the majority of Veterans pay a fee of 2.15%, the fee can range from 0.5% to 3.3%, depending on the type of loan, whether the borrower has utilized a VA loan before, and if a down payment greater than 5% has been made. While the VA requires most borrowers to pay this fee, there are exemptions, such as borrowers who receive compensation for service-connected disabilities.

The calculation of the VA Funding Fee depends on several factors, including the type of VA loan, whether the borrower has utilized the VA loan benefit before, and whether a down payment has been made. Borrowers with service-connected disabilities and certain others may be exempt from paying the fee entirely. While funding fees for Reservists and National Guard members were historically higher than those for regular military members, fees for all branches are now equal due to the passing of the Blue Water Navy Vietnam Veterans Act.

As you'll see in the VA funding fee table for 2023 below, Veterans purchasing with a VA loan for the first time receive a lower fee than subsequent users. Though not required, first-time and subsequent purchasers can decrease the funding fee with a minimum 5% down payment.

The following table shows the current VA funding fee rates on purchase loans for Veterans, active military, Reserves and National Guard members.

| Down Payment | First-Time VA Loan Use | Subsequent VA Loan Use |

| No Down Payment | 2.15% | 3.3% |

| 5% or more | 1.5% | 1.5% |

| 10% or more | 1.25% | 1.25% |

This communication is for informational purposes only. This is not a commitment to lend. All loans are subject to buyer and property qualification. All programs, rates, and fees are subject to change or cancelation at any time and without notice. Contact Mortgages by Richard to learn more about mortgage products and your eligibility.

Laura H. & Christopher M.

We were initially denied by a lender and when our possibilities were limited, Mr. Krauss helped us achieve our dream of getting a model home. My husband is a Veteran and he informed us of discounts and grants that we were not aware of.

Nicholas M.

I was well informed every step of the way never left me guessing all ways their when I had a question all ways very professional and respectful I had a pleasant experience.

Bonnie M.

Consistent communication and being able to trust the process. Richard closed my purchase after it was denied by another lender due to my low credit.

Natalie D.H.

Richard's quick response to any issue or questions I may have had. And his expertise in getting it all handled quickly. I am Self Employed, he was able to close the loan before the due date.

Lorine C.J.

Richard has successfully completed several refi’s for us which is why we brought our latest refi need to him. Our communication was excellent and our current refi went smoothly.

Nadine W.

Richard was able to close my VA Purchase ahead of time with a low credit score of 520. His expertise overcame every hurdle within the process.

Bryan P.

Richard took the time to help a homeless disabled Veteran into a new home. No one would help except for him. He explained how to qualify and executed my purchase ahead of schedule with the builder!

Roberto R.

I was in an active Chapter 13 Bankruptcy, Richard was able to contact the court for approval and assist with my new purchase. He then provided me with the SAH Grant information for disabled Veterans and helped with my disabilities in the new home.

Greg S.

Richard is my old high school friend. We both served in the military, and he was able to explain how I can purchase with a lower credit score. My family has a beautiful home and we are able to start our next chapter!

David S.

Richard executed a Cash Out refi to purchase an investment property. The loan was approved withing 5 Days. Extremely quick turn around and awesome communication. He always answered my questions.